The pureplay water midstream company bought the produced water infrastructure associated with Colgate’s purchase of Occidental acreage in June.

Expanding its holdings further in the Delaware Basin, WaterBridge Holdings closed a transaction with Colgate Energy to acquire the produced water infrastructure associated with Colgate’s purchase of Occidental acreage in June.

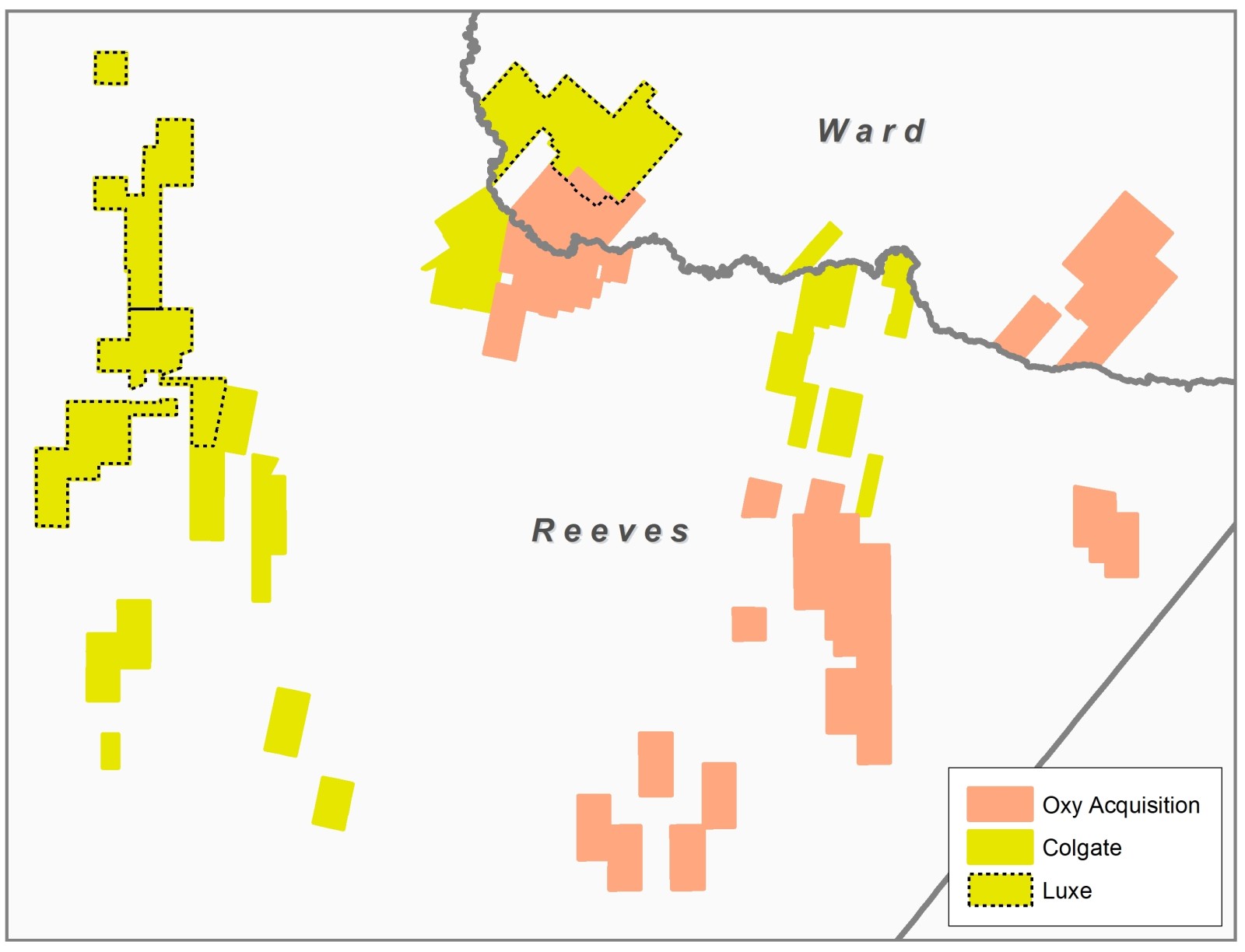

The companies entered into a 15-year produced water management agreement for all of Colgate’s operated acreage within Reeves and Ward counties, Texas.

The acquired assets include 10 water-handling facilities and associated water midstream infrastructure with aggregate handling capacity of approximately 100,000 B/D and approximately 50 miles of produced water pipelines.

WaterBridge will manage the produced water infrastructure and integrate these assets into its broader southern Delaware operations. WaterBridge and Colgate have consolidated existing produced water management contracts into a new produced water management services agreement in which Colgate has dedicated all the operated acreage recently acquired from Occidental and the legacy Colgate and Luxe Energy acreage previously dedicated to WaterBridge.

After the transaction, Colgate will have more than 86,100 gross operated acres dedicated to WaterBridge in the southern Delaware Basin.

Jason Long, co-chief executive officer and chief operating officer of WaterBridge, said, “This transaction further enhances our ability to manage and distribute over two million barrels per day of produced and recycled water across our Permian platform.”

With the closing of this transaction, WaterBridge has approximately 600,000 acres operated by more than 20 producers under long-term dedication in the southern Delaware Basin. The newly acquired infrastructure will be integrated into WaterBridge’s existing Delaware Basin water network, which following this transaction provides more than 2.1 million B/D of water-handling, reuse, and redelivery capacity via 959 miles of large-diameter pipelines and 97 water-handling facilities.

A pureplay, privately held midstream water management company in the southern Delaware and Arkoma Basins, WaterBridge has acquired the following assets over the past few years:

- December 2019—Produced water infrastructure from Primexx Energy Partners, Tall City Exploration III, and Jetta Permian, as well as organic growth projects in the southern Delaware Basin

- June 2019—PDC Energy’s produced water infrastructure in the Delaware

- January 2019—Produced water assets of COG Operating LLC, a subsidiary of Concho Resources, in the Delaware

- December 2018—All of Halcón’s existing water infrastructure assets in Pecos, Reeves, Ward, and Winkler counties, Texas, and water infrastructure assets from affiliates of NGL Energy Partners in the Delaware

- October 2017—Arkoma Water Resources’ water gathering and disposal infrastructure located in Hughes and Pittsburg counties, Oklahoma

- August 2017— EnWater Solutions’ produced water gathering and disposal infrastructure in the Delaware